Mastering the Direct Material Price Variance Formula: A Complete Guide

Accurate tracking ensures that any price difference evaluation reflects true production costs. Effective management of direct material variance can lead to significant savings and better resource allocation. It also helps identify inefficiencies within the supply chain or production process that may otherwise go unnoticed.

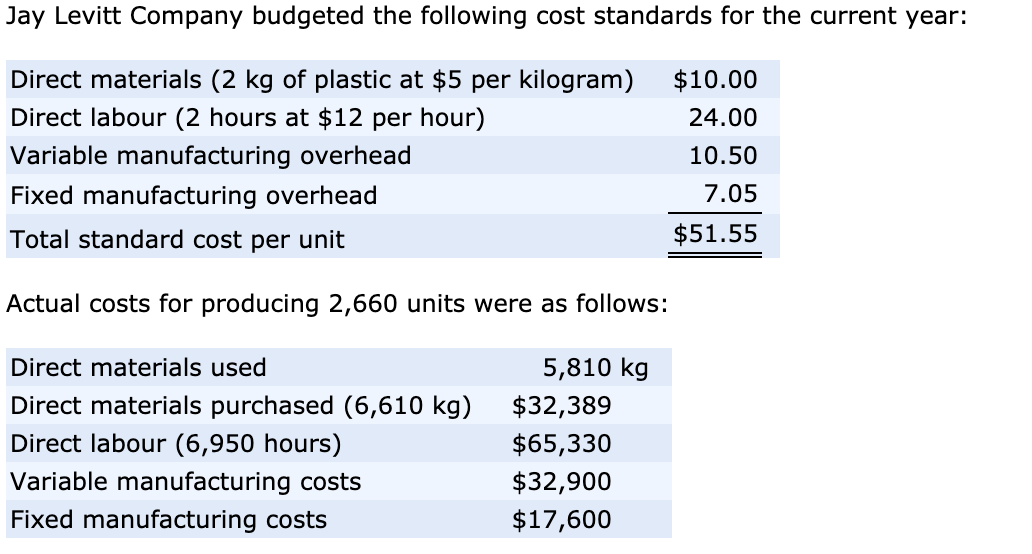

How to Compute Direct Materials Variances

That means the company spent less on materials than expected – a good thing! The result from this calculation gives you the direct material price variance for your accounting records. If materials cost more than planned, your variance will be negative, showing a loss against your standard cost. It’s important to note that direct material variance can be broken down into more specific components, such as price and quantity variances. However, the initial calculation provides a broad overview that can guide more detailed analysis. By regularly monitoring these variances, businesses can quickly identify trends or anomalies that may indicate underlying issues, such as supplier problems or inefficiencies in the production process.

- The material price variance is adverse because the actual price is higher than the standard.

- This clarity aids managers responsible for buying materials, like purchasing and warehouse managers, who need precise data for better sourcing decisions and negotiations with suppliers.

- For example, regression analysis might reveal that a 10% increase in supplier lead time results in a 5% increase in material quantity variance.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- Maybe they switched to a new supplier or had to order materials in a rush and paid more.

Calculator for Direct Material Price Variance

Material variance is the difference between the actual cost of direct materials and the expected cost of those materials. Direct materials quantity variance is also known as direct material usage or volume variance. The difference between the standard cost (AQ × SP) and the actual cost (AQ × AP) gives us the material price variance amount. You multiply the actual quantity of materials bought by the difference between standard and actual price per unit. The following equations summarize the calculations for direct materials cost variance. The valuation of stock on standard cost basis implies that the entire effect of any price variance is to be accounted for in the current period.

What is direct material price variance?

It is one of the variances which company need to monitor beside direct material usage variance. To begin with, calculating direct material variance involves comparing the standard cost of materials to the actual cost incurred. This comparison helps businesses understand whether they are spending more or less than anticipated on raw materials. The standard cost is typically derived from historical data, industry benchmarks, or predetermined budgets, while the actual cost is recorded during the production process.

Direct Material Quantity Variance FAQs

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

To calculate the material price variance, you must first know how much product your company used. You’ll need to gather data on the actual quantity of materials employed in production. Internal factors, such as production efficiency and waste management, significantly affect material quantity variance. Inefficient production processes, outdated machinery, or inadequate employee training can result in higher material consumption than planned. Implementing lean manufacturing techniques, investing in modern equipment, and providing ongoing training for employees can enhance production efficiency and reduce material waste. Additionally, regular audits of the production process can identify areas for improvement and help maintain optimal material usage.

You compare this with the “actual price,” what you actually end up paying. A favorable material price variance suggests cost effective procurement by the company. Direct Material Price Variance (DMPV) shows the amount by which the total cost of raw materials has deviated from the planned cost as a result of a price change over a period. An 5 5 cost-volume-profit analysis in planning managerial accounting unfavorable one might show supplier problems or rising costs in the industry. Let’s say your company set a budget of $5 for a pound of copper, but the market rates went up, and you ended up paying $6 per pound. To figure out the variance, subtract that actual price ($6) from the budgeted price ($5), giving you a difference of $1 per pound.

The difference column shows that 200 fewer pounds were used than expected (favorable). It also shows that the actual price per pound was $0.30 higher than standard cost (unfavorable). The direct materials used in production cost more than was anticipated, which is an unfavorable outcome. The direct materials quantity variance of Blue Sky Company, as calculated above, is favorable because the actual quantity of materials used is less than the standard quantity allowed.

The difference between the expected and actual cost incurred on purchasing direct materials, expressed as a positive or negative value, evaluated in terms of currency. The direct material price variance is favorable if the actual price of materials is __________ than the standard price. As businesses strive for greater precision in cost management, advanced techniques in variance analysis have become increasingly valuable. One such technique is the use of trend analysis, which involves examining variance data over multiple periods to identify patterns and trends.

Sharing variance reports and findings with relevant departments fosters a collaborative environment where everyone is aware of cost control objectives. For instance, procurement teams can work closely with suppliers to negotiate better prices, while production teams can implement process improvements to reduce material waste. This cross-functional collaboration ensures that all aspects of the business are aligned towards achieving cost efficiency. This setup explains the unfavorable total direct materials variance of $7,200 — the company gains $13,500 by paying less for direct materials, but loses $20,700 by using more direct materials.

120 N Congress St.

120 N Congress St.