The 8 Important Steps in the Accounting Cycle

It creates a debit for where the money is going, and a credit for where it is ending up. This period of time is often referred to as the accounting period. An accounting period is the time period that financial statements refer to. You have to make sure that all transactions are recorded in a timely manner so that they can be reported.

Step 4: Prepare adjusting entries at the end of the period

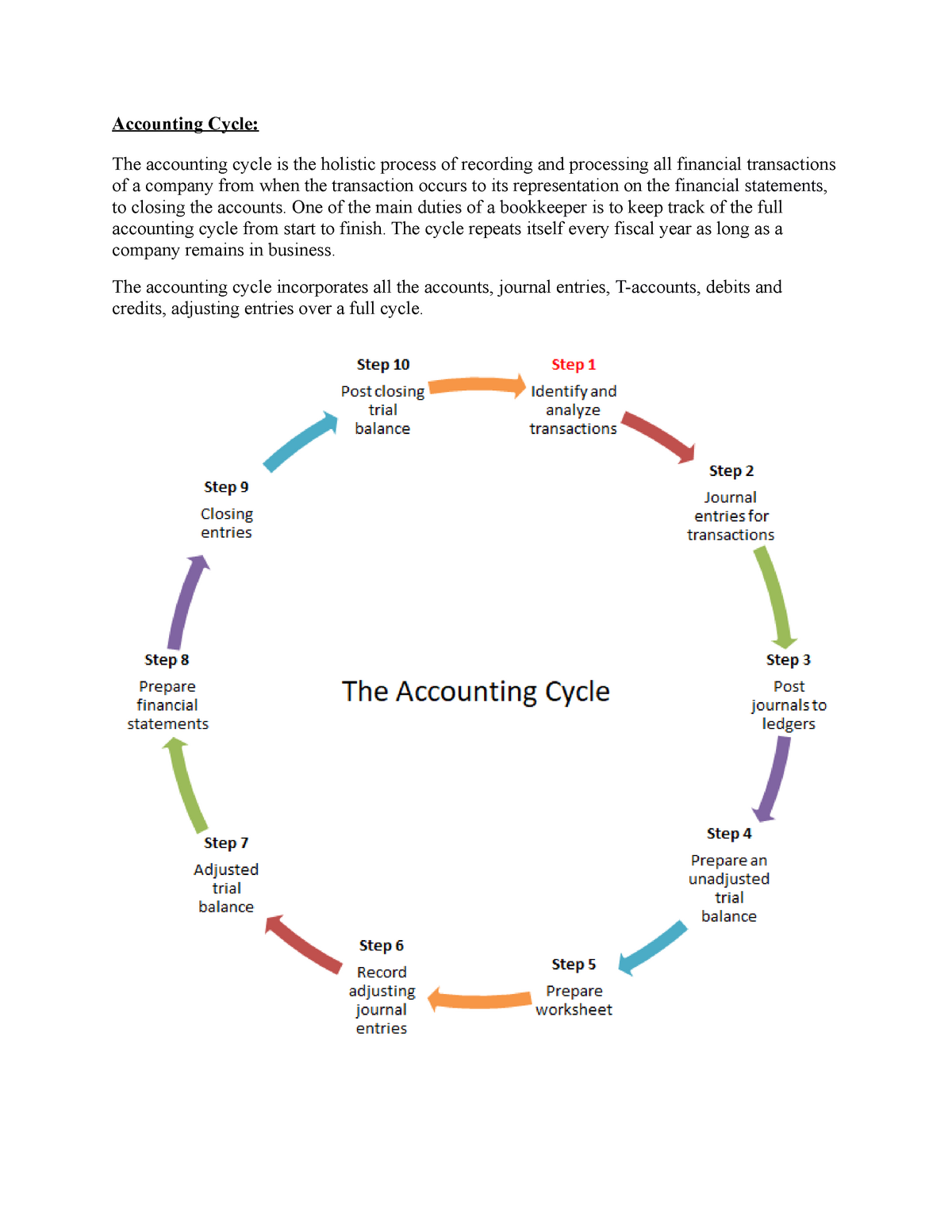

A budget cycle can use past accounting statements to help forecast revenues and expenses. The eight-step accounting cycle starts with recording every company transaction individually and ends with a comprehensive report of the company’s activities for the designated cycle timeframe. Many companies use accounting software or other technology to automate the accounting cycle. This allows accountants to program cycle dates and receive automated reports. The fundamental concepts above will enable you to construct an income statement, balance sheet, and cash flow statement, which are the most important steps in the accounting cycle.

The 9-step accounting process

HighRadius’s solutions not only optimize the accounting cycle but also ensure a faster, error-free close. Business transactions identified are then analyzed to determine the accounts affected and the amounts to be recorded. What’s left at the end of the process is called a post-closing trial balance.

Reversing Entries: Optional step at the beginning of the new accounting period

- These statements are helpful and show the company’s current financial position and performance.

- It starts when a transaction is made and ends when a financial statement is issued and the books are closed.

- Companies might employ multiple accounting periods, but it’s crucial to note that each period solely reports transactions within that time frame.

- Ultimately, understanding and executing the accounting cycle properly empowers you to steer your business toward greater financial stability.

After transactions have been identified, they have to be recorded. If a transaction is identified but it isn’t recorded, then it’s like it never happened at all. This article delves into the nuances of these steps and highlights its significance in promoting transparency, accountability, and well-informed decision-making in the business sphere. Additionally, we explore the impact of technology as a catalyst in optimizing the efficiency and effectiveness of the accounting cycle, streamlining routine tasks and augmenting accuracy. To simplify the recording process, special journals are often used for transactions that recur frequently, such as sales, purchases, cash receipts, and cash disbursements. And, a general journal is used to record all those that do not fit in the special journals.

Transaction recording in journal

In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual accounting. For example, public entities are required to submit financial statements by certain dates. All public companies that do business in the U.S. are required to file registration statements, periodic reports, and other forms to the U.S.

If you buy some new business cards, for example, your marketing expense account is debited, and your bank account is credited. Or, if you receive a payment, your sales revenue is credited while your bank account is debited. The ledger is a large, numbered list showing all your company’s transactions and how they affect each of your business’s individual accounts. The accounting cycle is important because it gives companies a set of well-planned steps to organize the bookkeeping process to avoid falling into the pitfalls of poor accounting practices. Before you create your financial statements, you need to make adjustments to account for any corrections for accruals or deferrals. Recordkeeping is essential for recording all types of transactions.

Essentially, the 30% of business failures are caused by employee theft represents a carefully orchestrated series of steps that converts raw financial data into meaningful and comprehensible reports. Regardless of the scenario, an unadjusted trial balance displays all your credits and debits in a table. Once transactions are recorded in journals, they are also posted to the general ledger. A general ledger is a critical aspect of accounting as it serves as a master record of all financial transactions. Learn the eight steps in the accounting cycle process to complete your company’s bookkeeping tasks accurately and manage your finances better. Temporary or nominal accounts, i.e. income statement accounts, are closed to prepare the system for the next accounting period.

Fortunately, nowadays, you can automate these tasks with accounting software, so doing all this isn’t as time-consuming as it might seem at first glance. A shorter internal accounting cycle can make bookkeeping more manageable, especially when the company’s finances are complicated. However, businesses with internal accounting cycles also follow the external accounting cycle of the fiscal year. Use of a checklist with deadlines in the accounting cycle improves accountability and process management. The operating cycle can be expressed in a formula as the sum of the financial analysis ratios for days’ sales outstanding and the average collection period. Understanding the operating cycle in your business is essential for cash flow management.

It records where cash is going, as well as where it’s coming from. One of the accounting cycle’s main objectives is to ensure all the finances during the accounting period are recorded and reflected in the statements accurately. It’s like a checklist to complete when an accounting period ends. The accounts are closed to a summary account (usually, Income Summary) and then closed further to the capital account. Again, take note that closing entries are made only for temporary accounts.

120 N Congress St.

120 N Congress St.