What is the Periodicity Assumption?

The time period principle is rigorously enforced, because a high degree of consistency is needed in reporting financial statements. By following this principle, your organization can produce financial statements that are comparable to the results reported for prior years. This is needed by investors, lenders, and others who read the financial statements, and who may want to conduct multi-period analyses. The accrual method in accounting means that “revenue or income is recognized when earned regardless of when received and expenses are recognized when incurred regardless of when paid”.

The Rules Followed by Accountants When Preparing Financial Statements

The general concept of the time period principle assumes that all businesses can divide their financial activities into artificial time periods. In other words, all revenues and expenses can be systematically assigned to distinctive and consecutive accounting time periods. who can i claim as a dependant on my tax return is not just an accounting convenience; it is a strategic tool that influences a wide range of business decisions. Whether it’s a manager planning the next quarter, an investor assessing risk, or a creditor evaluating creditworthiness, the time period assumption serves as a common language in the financial dialogue of business.

Ask Any Financial Question

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- Time period assumptions are used to provide a more accurate picture of the value of assets and liabilities held for long periods and how business is doing throughout each month or quarter.

- Regulatory bodies enforce the Realization Principle to maintain consistency and comparability across financial statements.

- This division facilitates the timely reporting of financial performance and position to stakeholders.

- Managers can set periodic targets and compare actual performance against these benchmarks, making necessary adjustments to operations and strategies.

This indicates the period covered in the financial statements and is useful when analyzing the financial statements across different periods. The going concern principle states that businesses should assume they will continue to operate and exist in the foreseeable future, and not liquidate. This assumption therefore allows businesses to defer some accrued expenses to future accounting periods. In order to do so, the an accounting period needs to be defined, which is where the time period principle comes in. From the perspective of management, the time period assumption facilitates internal control and performance evaluation. Managers can set periodic targets and compare actual performance against these benchmarks, making necessary adjustments to operations and strategies.

Impact of Time Period Assumption on Financial Decisions

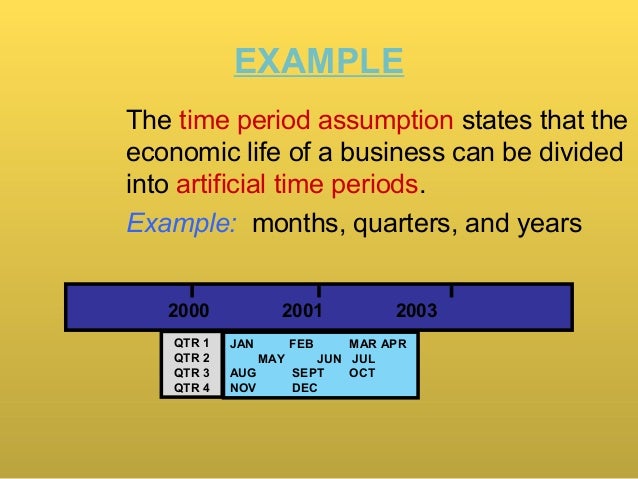

The business operation will continue for a long time, but accountant needs to prepare financial statements for the management to make a proper and timely decision. Annual reports are usually called the physical year, and any report less than that is called an interim report. The periodicity assumption, also known as the time period assumption, is an accounting guideline which states that the economic life of a business can be divided into artificial time periods. These time periods, or intervals, are typically a month, quarter, or a year, although it could be any interval of time over which the business wants to measure financial performance and financial position.

While such practices are legal and sometimes necessary, they must be balanced with ethical considerations and long-term business health. – The periodicity assumption is an interesting compromise between accounting relevance and reliability. Outside users of financial statements want financial information as soon as possible in order for it to be relevant in their decision-making. For instance, monthly financial statements give investors great performance information in a timely manner.

The importance of time period principle

The concept of time plays a pivotal role in accounting practices, particularly when distinguishing between accrual and cash accounting methods. The time period assumption, a fundamental principle in accounting, posits that business operations can be recorded and reported over specific periods. This assumption is integral to accrual accounting, which records financial events based on economic activity rather than actual cash flow. Conversely, cash accounting is predicated on the exchange of cash and does not recognize receivables or payables. While the time period assumption is a cornerstone of financial reporting, it must be applied judiciously, considering its interplay with other accounting principles.

From an accountant’s perspective, the Realization Principle ensures that financial statements present a company’s revenue based on actual economic events rather than mere cash transactions. This approach helps in assessing the true performance of a business, as it aligns revenue recognition with the delivery of goods or services. Investors and creditors want the most current information possible to base their financial decisions on. For instance, investors often look at quarterly financial statements in order to predict what the business performance might be in the next quarter.

However, the realization principle would dictate that revenue from this contract should not be recognized until the goods or services are delivered, even if payment was received in advance. The future of time-based revenue recognition is poised to undergo significant evolution as businesses and regulatory bodies adapt to the changing economic landscape. This evolution is driven by the need for more accurate financial reporting that reflects the complexities of modern revenue streams.

Furthermore, this one year period can be subdivided into interim periods where financial statements are prepared in a monthly, quarterly or semi-annual basis. The time period assumption is a cornerstone of accrual accounting that facilitates the orderly and meaningful presentation of financial information. It allows stakeholders to assess a company’s performance over consistent and regular intervals, providing a temporal framework that is essential for financial analysis, decision-making, and strategic planning. Without it, the financial landscape would be devoid of the rhythm and continuity necessary for understanding a business’s financial journey.

This assumption divides an entity’s complex, ongoing financial activities into periods such as months, quarters, or years, facilitating periodic reporting that is essential for stakeholders to make informed decisions. This assumption is crucial as it provides a structured framework for reporting, analyzing, and comparing financial information over specific periods. By adhering to this assumption, companies can offer stakeholders timely and relevant financial data, which is essential for informed decision-making. The time period assumption is a fundamental principle in accrual accounting, which stipulates that the life of a business can be divided into artificial time periods to provide timely information to users.

120 N Congress St.

120 N Congress St.